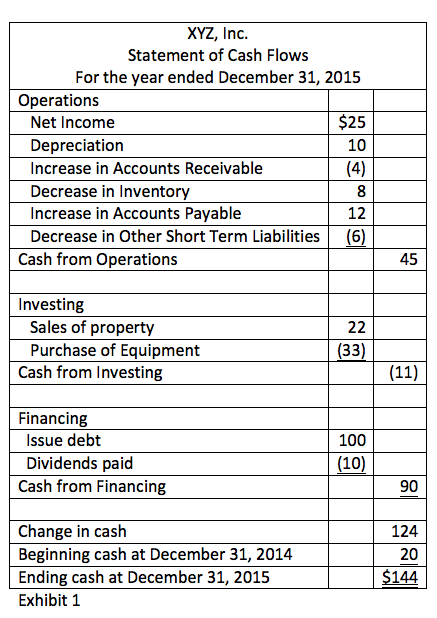

Negative cash flow typically shows that more cash is leaving the company than coming in, which can be a reason for concern as the company may not be able to meet its financial obligations in the future. However, this could also mean that a company is investing or expanding which requires it to spend some of its funds. Other companies may also have a higher capital investment which means they have more cash outflow rather than cash inflow. The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. This is another example of a cash flow statement of Nike, Inc. using the indirect method for the fiscal year ending May 31, 2021. This method of calculating cash flow takes more time since you need to track payments and receipts for every cash transaction.

- Companies generally aim for a positive cash flow for their business operations without which the company may have to borrow money to keep the business going.

- In other words, the investing section of the statement represents the cash that the company either collected from the sale of a long-term asset or the amount of money spent on purchasing a new long-term asset.

- For instance, assume a company issued a mortgage note to acquire land and buildings.

- As we have discussed, the operating section of the statement of cash flows can be shown using either the direct method or the indirect method.

- Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

To Ensure One Vote Per Person, Please Include the Following Info

The $171,000 debit entry in the debit column is the cost of the equipment that was purchased on September 12. The sale results in a cash inflow, and the purchase results in a cash outflow. operating ratio top 3 different examples of operating ratio On the same day you pay your cell phone bill and car insurance payment for a total of $210. The net cash inflow on that day is $160; that is, $160 more came in than went out.

Cash Flow Statement Indirect Method

If the starting point profit is above interest and tax in the income statement, then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows. Clearly, the exact starting point for the reconciliation will determine the exact adjustments made to get down to an operating cash flow number. The issuance of debt is a cash inflow, because a company finds investors willing to act as lenders. However, when these debt investors are paid back, then the repayment is a cash outflow.

Differences Between the Direct and Indirect Methods

The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Our easy online enrollment form is free, and no special documentation is required. No, all of our programs are 100 percent online, and available to participants regardless of their location. Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community.

What are the main components of a cash flow statement?

Let’s consider a company that sells a product and extends credit for the sale to its customer. Even though it recognizes that sale as revenue, the company doesn’t yet have the cash. Nevertheless, it earns a profit on the income statement and pays income taxes on that profit. If it does this too often, it faces the danger of running out of cash despite technically being profitable. The sum of the cash generated by these three segments is called “net cash flow.” Each has its own section of the cash flow statement, which helps investors determine the value of a company’s stock or the company as a whole. Cash flow statements are one of the most critical financial documents that an organization prepares, offering valuable insight into the health of the business.

2.5 Comparative Operating Activities Sections – Statement of Cash Flows

The consolidated profit or loss for the period, net of income taxes, including the portion attributable to the noncontrolling interest. Amount of cash inflow from contractual arrangement with the lender, including but not limited to, letter of credit, standby letter of credit and revolving credit arrangements. Amount of cash inflow from issuance of shares under share-based payment arrangement.

But it is not as easily manipulated by the timing of non-cash transactions. As noted above, the CFS can be derived from the income statement and the balance sheet. Net earnings from the income statement are the figure from which the information on the CFS is deduced.

Learn how to analyze a statement of cash flows in CFI’s Financial Analysis Fundamentals course. Free Cash Flow is not necessarily a measure of our ability to fund our cash needs. The Company believes the presentation of these measures is relevant and useful for investors because it allows investors to view performance in a manner similar to the method used by the Company’s management. The Company believes it helps improve investors’ ability to understand the Company’s operating performance and makes it easier to compare the Company’s results with other companies that have different capital structures or tax rates. Consolidated Selling, General & Administrative (“SG&A”) expenses increased $25.2 million, or 6.4%, during the three months ended September 30, 2024 compared to the same period of 2023.

Cash payments to settle accounts payable, wages payable, and income taxes payable are not financing activities. This information is available only in bits and pieces from the other financial statements. Since cash flows are vital to a company’s financial health, the statement of cash flows provides useful information to management, investors, creditors, and other interested parties. Purposes of the statement of cash flowsThe main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. Broadly defined, cash includes both cash and cash equivalents, such as short-term investments in Treasury bills, commercial paper, and money market funds.

The investing and financing section both are prepared using a direct method. Financing activities generally include the cash effects (inflows and outflows) of transactions and other events involving creditors and owners. Cash inflows from financing activities include cash received from issuing capital stock and bonds, mortgages, and notes, and from other short- or long-term borrowing. Cash outflows for financing activities include payments of cash dividends or other distributions to owners (including cash paid to purchase treasury stock) and repayments of amounts borrowed. Payment of interest is not included because interest expense appears on the income statement and is, therefore, included in operating activities.

These figures can also be calculated by using the beginning and ending balances of a variety of asset and liability accounts and examining the net decrease or increase in the accounts. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Cash flow is the total amount of cash that is flowing in and out of the company. Free cash flow is the available cash after subtracting capital expenditures.