The straight line depreciation method takes the purchase or acquisition price, subtracts the salvage value and then divides it by the total estimated life in years. The accelerated Depreciation method allows the deduction of higher expenses in the first years after purchase and lower expenses as the asset ages. Straight-Line Depreciation, on the other hand, spreads the cost evenly over the life of the asset.

Benefits of Accelerated Depreciation

This could lead to differences between the asset’s market and book values, hurting investment analysis. Especially with tech assets, which can depreciate quickly, this might cause gaps in the book and market values, affecting accounting numbers like depreciation vs write-off. Assets that a company buys and expects to last more than one year are referred to as fixed assets. These can be things such as office furniture, computers, buildings or company cars. Even though the expectation is that they will last longer than a year, these assets do not last forever.

- As an asset ages, it is not used as heavily, since it is slowly phased out for newer assets.

- Many accountants use a simple, easy-to-use method called the straight-line basis.

- In order to make the comparison as fair as possible, let’s assume company XYZ is just starting out as a business and they bought several new computers for their staff.

Optimizing Asset Management

For example, a tech company investing heavily in R&D might opt for accelerated depreciation to quickly write off their equipment, aligning expenses with the rapid pace of technological obsolescence. Conversely, a real estate company might choose straight-line depreciation for its buildings to ensure steady profit reporting. Each year, the company would report a $9,000 depreciation expense for this asset, which straight line depreciation vs accelerated would reduce the taxable income by the same amount, assuming tax laws allow for depreciation deductions. You can use the straight-line depreciation method to keep an eye on the value of your fixed assets and predict your expenses for the next month, quarter, or year. If your company uses a piece of equipment, you should see more depreciation when you use the machinery to produce more units of a commodity.

Accelerated Depreciation at Work

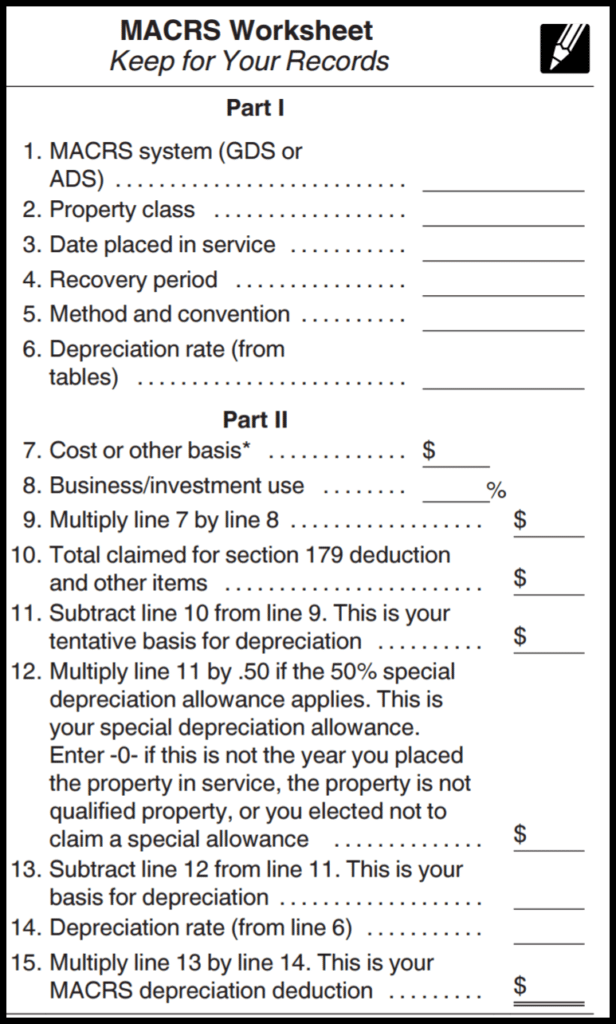

The straight-line method of depreciation can be used to depreciate almost any type of tangible assets such as property, furniture, computers, and equipment. For example, technology companies with rapidly obsolescing equipment might favor accelerated depreciation to match the expense with the asset’s quickly diminishing value. Once you understand the asset’s worth, it’s time to calculate depreciation expense using the straight-line depreciation equation. By estimating depreciation, companies can spread the cost of an asset over several years. The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciation. Straight-line depreciation is an accounting method that measures the depreciation of a fixed asset over time.

Other depreciation methods

The asset account category includes intangible assets, which are not physical assets. Amortisation expenses are used to post a decline in the value of these assets. The expenses in the accounting records may be different from the amounts posted on the tax return.

SYD is an accelerated method that is used with the straight-line depreciation formula. This depreciation method is used to frequently reduce the value of an asset throughout its useful life. A variation on this method is the 150% declining balance method, which substitutes 1.5 for the 2.0 figure used in the calculation. The 150% method does not result in as rapid a rate of depreciation at the double declining method, and so is used less frequently.

The method chosen for this allocation can significantly impact a company’s financial statements and tax liabilities. Two common methods are the Straight Line and Accelerated depreciation. From an accountant’s perspective, the predictability of straight line depreciation makes it easier to forecast financial statements and manage budgets. It aligns with the matching principle in accounting, which states that expenses should be matched with the revenues they help to generate. For tax purposes, this method may also be beneficial as it can lead to a steady claim of depreciation expenses over the years.

If you can’t determine a measurable difference in depreciation from one year to the next, use the straight-line depreciation schedule. Depreciation expenses are posted to recognise a fixed asset’s decline in value. The straight-line method is the most common method used to record depreciation. This article defines and explains how to calculate straight-line depreciation. In addition to this, learn more about ways to calculate the expense, and how depreciation impacts financial statements.