On the other hand, company XYZ, a competitor of ABC in the same sector, had a total revenue of $8 billion at the end of the same fiscal year. Its total assets were $1 billion at the beginning of the year and $2 billion at the end. Irrespective of whether the total or fixed variation is used, the asset turnover ratio is not practical as a standalone metric without a point of reference. Just-in-time (JIT) inventory management, for instance, is a system whereby a firm receives inputs as close as possible to when they are needed. So, if a car assembly plant needs to install airbags, it does not keep a stock of airbags on its shelves but receives them as those cars come onto the assembly line. Tighter control of inventory, including returns and damaged goods, will help you bring up your net sales number (and lower your cost of goods sold) and ultimately increase your assets turnover ratio.

What is the approximate value of your cash savings and other investments?

You can locate your net sales number on your income statement (also known as your profit and loss statement). This is your total sales number, minus any returns, damaged goods, missing goods, etc. Rather than gross sales, your net sales is the more accurate figure to use when you’re generating your asset turnover ratio. Remember that net sales only accounts for the products that end up in your customers’ hands at the end of the year—in other words, what they actually paid for. Your asset turnover ratio is an equation to help you figure out how you’re using your assets to generate sales.

What is the total asset turnover ratio? The meaning of the total asset turnover formula

Others, particularly that are service-based, will have a much lower ratio. You don’t want to be judging yourself on a metric you set yourself—especially when it’s one that’s meant to help you improve your business. Average total assets attention required! cloudflare value is calculated by adding the beginning and ending balance of total assets and dividing the sum by 2. This ratio may seem unnatural, but it is helpful when assessing how efficiently the assets of a business are being used.

Everything You Need To Master Financial Modeling

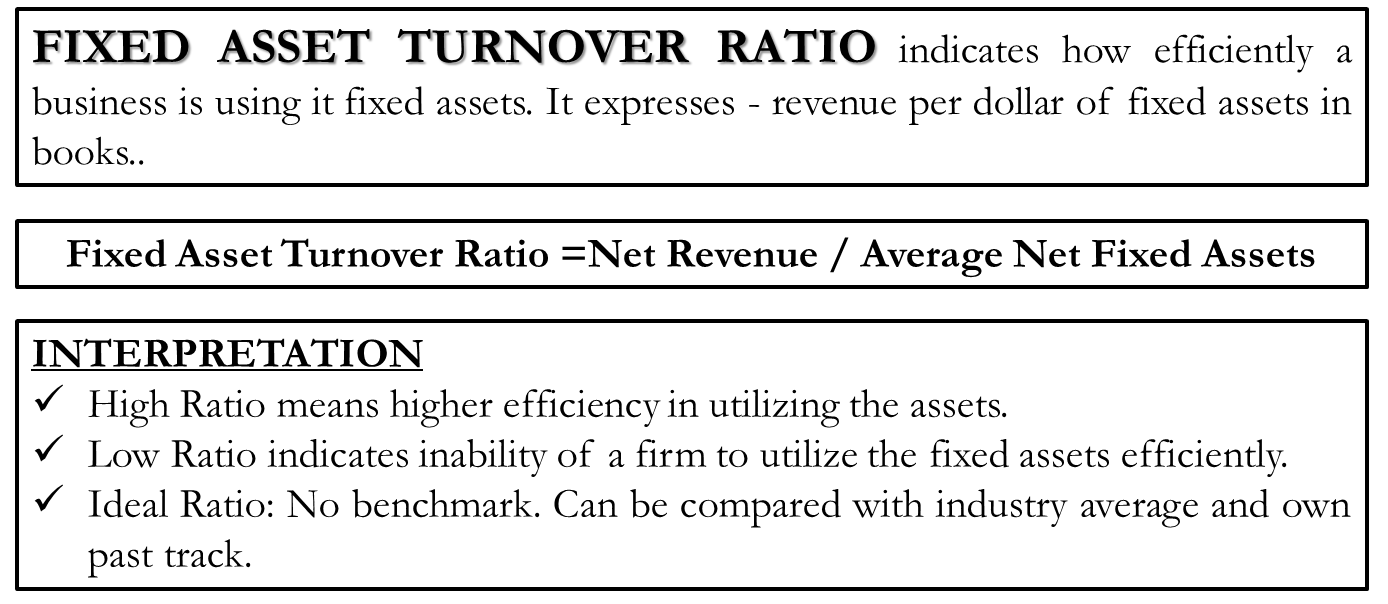

This figure represents the average value of both your long- and short-term assets over the past two years. To reach this number, you’ll need (unsurprisingly) two years of asset totals; you can find this information on your accounting balance sheet. Once you have your current year number and your previous number, add them up and divide them by two for the average. We’ll show you how to calculate the asset turnover ratio equation, and why it’s important to understand this accounting term. Check out our debt to asset ratio calculator and fixed asset turnover ratio calculator to understand more on this topic. The following article will help you understand what total asset turnover is and how to calculate it using the total asset turnover ratio formula.

Would you prefer to work with a financial professional remotely or in-person?

Moreover, the company has three types of current assets—cash and cash equivalents, accounts receivable, and inventory—with the following carrying values recorded on the balance sheet. Hence, we use the average total assets across the measured net sales period in order to align the timing between both metrics. But you’re not the only one who can benefit from understanding your asset turnover ratio.

How to Improve Your Asset Turnover Ratio

It would not make sense to compare the asset turnover ratios for Walmart and AT&T, since they operate in different industries. Comparing the relative asset turnover ratios for AT&T with Verizon may provide a better estimate of which company is using assets more efficiently in that sector. The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets.

- Each industry has different norms for asset turnover ratios, so it’s best to only compare companies within the same sector.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Eliminate hours of searching for specific data points buried deep inside company material.

The ratio can also change significantly from year to year, so just because it’s low one year doesn’t mean it will remain low over time. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Meanwhile, firms in sectors like utilities or manufacturing tend to have large asset bases, which translates to lower asset turnover. Publicly-facing industries including retail and restaurants rely heavily on converting assets to inventory, then converting inventory to sales. Other sectors like real estate often take long periods of time to convert inventory into revenue. Though real estate transactions may result in high profit margins, the industry-wide asset turnover ratio is low. The asset turnover ratio can also be analyzed by tracking the ratio for a single company over time.