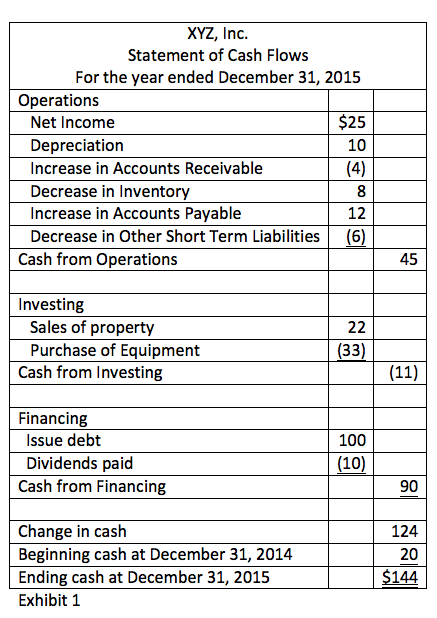

The statement also informs about cash outflows, expenses paid for business activities and investment at a given point in time. The information that you get from the cash flow statement is beneficial for the management to take informed decisions for regulating business operations. The statement of cash flows is a relatively important statement in the company finances as its only function consists of supplying monetary information in regard to the situation of money the company is in.

Cash from Financing Activities

Calculate net cash flows from investing activities amount by deducting cash outflows from cash inflows. This final summary amount indicates that $28,000 more “came in” than was paid out during this year for investing activities. (If it were free donation invoice template a net cash outflow, use parenthesis to indicate this.) This is the second of six numbers in the right-hand column. There are too many transactions to make it practical to look at each one individually to determine its impact on cash flow.

Cash Flow from Financing Activities

Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future. Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders, the company is reducing its cash.

- The cash flow statement measures the performance of a company over a period of time.

- Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category.

- As of September 30, 2024, we had $431.8 million of cash on our balance sheet.

- Financing activities detail cash flow from both debt and equity financing.

Additional Resources

Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues. For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available. In-depth analysis, examples and insights to give you an advantage in understanding the requirements and implications of financial reporting issues. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

After accounting for all of the additions and subtractions to cash, he has $6,000 at the end of the period. Under Cash Flow from Investing Activities, we reverse those investments, removing the cash on hand. They have cash value, but they aren’t the same as cash—and the only asset we’re interested in, in this context, is currency. Since it’s simpler than the direct method, many small businesses prefer this approach.

After this, it lists non-cash items involving operational activities and convert them into cash items. A business’ cash flow statement should show adequate positive cash flow for its operational activities. If it doesn’t, the business may find it difficult to manage its daily business operations. A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization.

You use information from your income statement and your balance sheet to create your cash flow statement. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable, inventory, and accounts payable. Utilizing historical data from the cash flow statement in “Analyzing Statements of Cash Flows II” helps forecast future cash flows. By analyzing trends in each section of the statement, you can project potential cash inflows and outflows, giving a clearer picture of future liquidity. This forecasting is beneficial for budgeting, financial planning, and ensuring the company has adequate cash reserves to support growth or handle economic downturns. The direct method of calculating cash flow from operating activities is a straightforward process that involves taking all the cash collections from operations and subtracting all the cash disbursements from operations.

These insights are indispensable for evaluating a company’s liquidity and financial agility. At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the reporting period. Therefore, the final balance of cash and cash equivalents at the end of the year equals $14.3 billion. The starting cash balance is necessary when leveraging the indirect method of calculating cash flow from operating activities.

Similarly, if a fixed asset’s balance decreases from one year to the next, it means that some or all of it was sold and there was a cash inflow. To help determine the amount of cash received or paid, refer to the journal entry for each transaction to see if Cash was debited or credited. Tallying all these adjustments to net income shows Clear Lake’s net cash flows provided by operating activities of $53,600 (see Figure 5.16). A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters.

Amount of cash inflow (outflow) from operating activities, including discontinued operations. Operating activity cash flows include transactions, adjustments, and changes in value not defined as investing or financing activities. Amount of cash inflow (outflow) from investing activities, including discontinued operations. Investing activity cash flows include making and collecting loans and acquiring and disposing of debt or equity instruments and property, plant, and equipment and other productive assets. Cash flows related to investing activities provide insights into the company’s strategic direction and capital allocation. In “Analyzing Statements of Cash Flows II,” you evaluate these investment cash flows to understand whether funds are being used for expansion, asset acquisition, or technological upgrades.

The cash outflow for securities or other assets acquired, which qualify for treatment as an investing activity and are to be liquidated, if necessary, within the current operating cycle. Amount of cash and cash equivalents, and cash and cash equivalents restricted to withdrawal or usage. Cash flow statement is a statement that tallies up every sum that cash was received and every sum that was spent with cash during the period, say one month, three months or one year in the business.